News

New Article Published in ACM Computing Surveys “Automated Market Makers in Cryptoeconomic Systems: A Taxonomy and Archetypes”

Authored by Daniel Kirste, Niclas Kannengießer, Ricky Lamberty, and Ali Sunyaev, the research examines how AMMs can be designed to ensure sufficient liquidity and accurate price discovery across different applications.

The study analyzes 122 scientific publications and 110 real-world AMM implementations, presenting:

- A systematic taxonomy with 16 dimensions and 43 characteristics of AMM design trade-offs

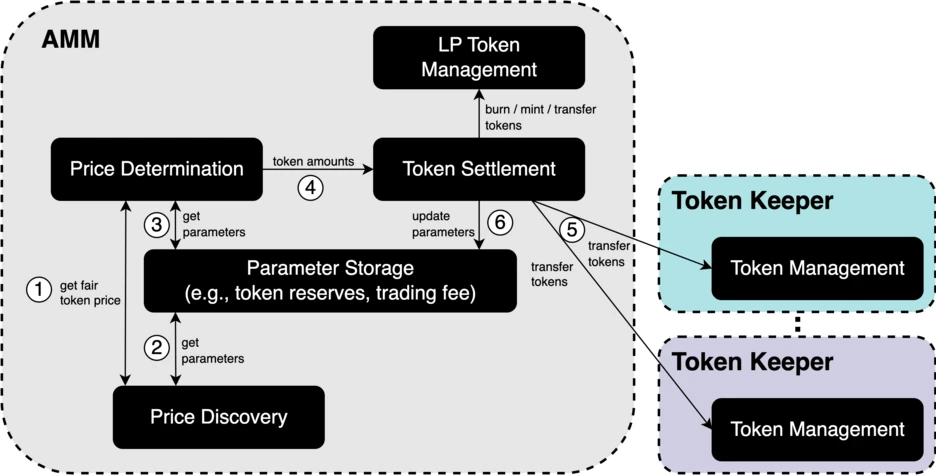

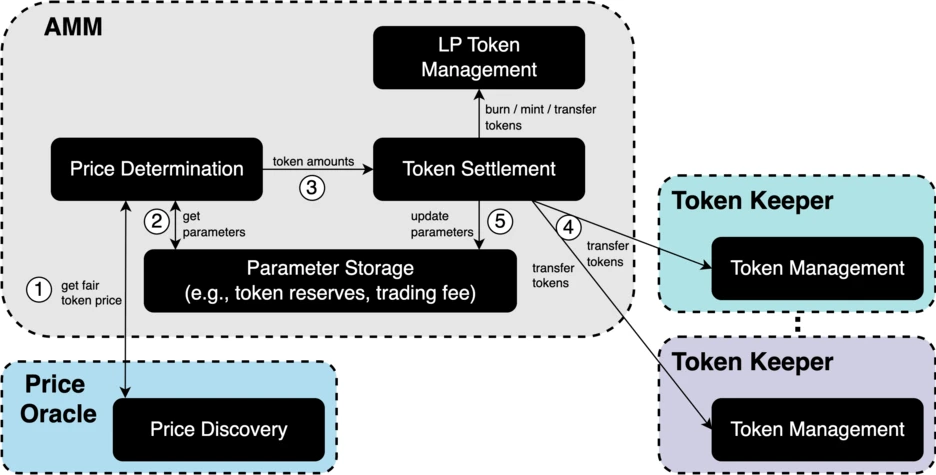

- Three distinct AMM archetypes: Price-discovering LP-based AMMs (e.g., Uniswap, Curve), Price-adopting LP-based AMMs (e.g., DODO, WOOFi), and Price-discovering Supply-sovereign AMMs (e.g., Bonding Curves)

- Mappings between archetype designs and their optimal use cases, including token exchanges, issuance, and prediction markets

Abstract:

The proper design of automated market makers (AMMs) is crucial to enable the continuous trading of assets represented as digital tokens on markets of cryptoeconomic systems. Improperly designed AMMs can make such markets suffer from the thin market problem (TMP), which can cause cryptoeconomic systems to fail their purposes. We developed an AMM taxonomy that showcases AMM design characteristics. Based on the AMM taxonomy, we devised AMM archetypes implementing principal solution approaches for the TMP. The main purpose of this article is to support practitioners and researchers in tackling the TMP through proper AMM designs.

Link to publication: https://dl.acm.org/doi/abs/10.1145/3769669